What you need to know about General Liability insurance

General Liability insurance (GL) is one of the first policy types that most businesses consider. Even if you don’t hire people or own property, your business needs basic protection from risks that are…well…general! There are an infinite number of ways that you might accidentally cause damage to property or injure someone personally or financially. These highly unusual and unpredictable circumstances are the exact scenarios that General Liability Insurance is designed to insure against so your business assets and income are protected.

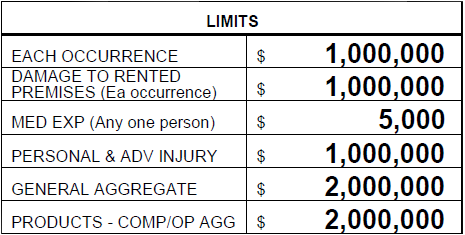

This is what general liability coverage might look like on your policy or insurance certificate.

The Cost of General Liability Insurance

General liability is also relatively inexpensive for most small businesses. It’s also the coverage most customers want to you to have to make sure they’re protected when they hire you to do work for them.

There is some variation in policies but the most common exclusions are things like auto liability, professional liability, aircraft liability, and employee liability. Many, if not most, of the things that General Liability excludes can be covered by adding endorsements or separate policies to fill the gaps. This is what a good agent will help you do.

General Liability is not required by law in most cases, however, any potential customer has the right to require you to show evidence of insurance before hiring your company to provide a service for them. In fact, it’s usually a prudent thing for customers to do.

There are some cases where a license may be required by law. For example, a state or municipality may require that a certain type of contractor or service provider maintain General Liability insurance in order to hold a particular license. Maintaining insurance is also considered to be financially prudent, so if you find yourself in a legal battle where you have caused damage or injury and are uninsured, the lack of an insurance policy may affect the judge or jury’s perception of you. In legal terms, what is “reasonable” or “expected” is often quite different than what is required or permissible by law.

In most cases, yes- it’s cheaper to buy a package policy that includes General Liability. General Liability policies are often packaged with coverage for property (buildings, equipment, supplies, tools, inventory, etc.), commercial vehicles, and workers comp. Consolidating your policies with the same company (or at least the same agent) can help you avoid gaps in coverage and save money overall. For smaller businesses, a package policy may actually be cheaper than a stand alone policy.